Kathmandu, August 6

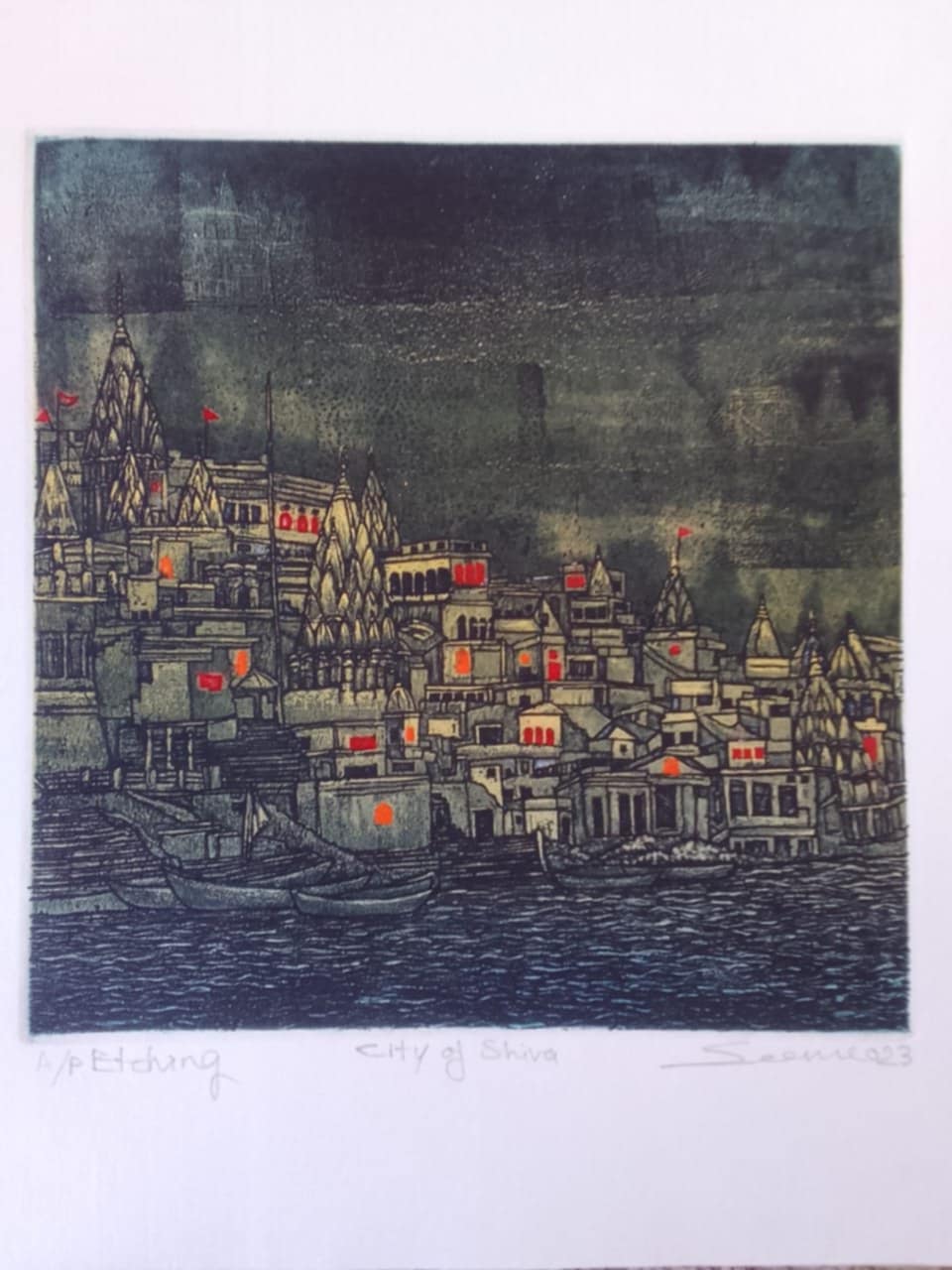

The Civil20 Summit 2023, a premier international CSOs meeting focused on shaping policies and advocating for civil society, successfully took place in Jaipur, India, from July 29 to 31.

The event brought together prominent CSO leaders, activists, and experts from around the globe, providing a platform to discuss pressing global challenges and collectively work towards a brighter and more sustainable future.

The Summit brought together CSOs around the world to collaboratively develop a comprehensive set of policy recommendations, referred to as the C20 Policy Pack, emphasising the vital role of civil society in influencing decision-making in the twenty nations, which have important implications for other developing and least developed countries.

The recommendations will be presented to the G20 leaders, urging them to consider civil society’s insights in shaping global policies.

During the Summit, South Asia Alliance for Poverty Eradication (SAAPE), with its Secretariat based in Kathmandu, and PRAKARSA, an Indonesia-based think tank, along with LDC Watch and Tax and Fiscal Justice Asia (TAFJA), jointly organised a side-event titled “Making Finance Work for People: A ‘Wealth Tax’ to Address Growing Inequality”.

The message of the event was that a progressive net wealth tax can provide crucial domestic resources for post-Covid and debt crisis recovery.

Research by SAAPE, for instance, showed that progressive net wealth taxation on millionaires (with a net worth above USD 5 million) could raise USD 84.3 billion, enough to triple healthcare spending.

The Special Committee of Financial Issues of the Civil20 also intensively discussed the wealth tax as one of the most direct instruments to establish fair taxation for improving social contracts.

Herni Ramdlaningrum, a Program Manager at PRAKARSA, said “Economic inequality has reached unprecedented levels, exacerbated by the Covid pandemic and subsequent financial crises. Tackling this pressing issue requires a sustainable increase in revenue. A wealth tax represents one of the most direct instruments to foster a fairer distribution of wealth and generate state revenue to promote gender equality, provide essential services for women, including maternal healthcare, and support women who have been disproportionately engaged in unpaid care work.”

Sudhir Shrestha, a researcher from SAAPE, said, “Wealth tax has the potential to raise significant domestic revenue in South Asia that can finance public services, including health and education, that would be of high quality, universal and free at the point of use.”

Arjun Kumar Karki, the Global Coordinator of LDC Watch, further added, “Wealth tax is not just linked to domestic revenue mobilisation but is an instrument to address human rights, social justice, and social inclusion.”