Every year, Nepal Rastra Bank prints new notes worth in excess of Rs 50 billion. As they are printed before Dashain and Tihar, the two biggest festivals of Nepal, the new notes go bad quite quickly which has started a debate whether Nepal should be wasting so much money on printing new notes.

The loop of losses

Even this year, the central bank printed notes worth Rs 60 billion. According to the executive director of the NRB Currency Management Department, Rewati Raman Nepal, most of these new notes will come back to the NRB quite quickly as they will be unusable. These old notes are then burnt down.

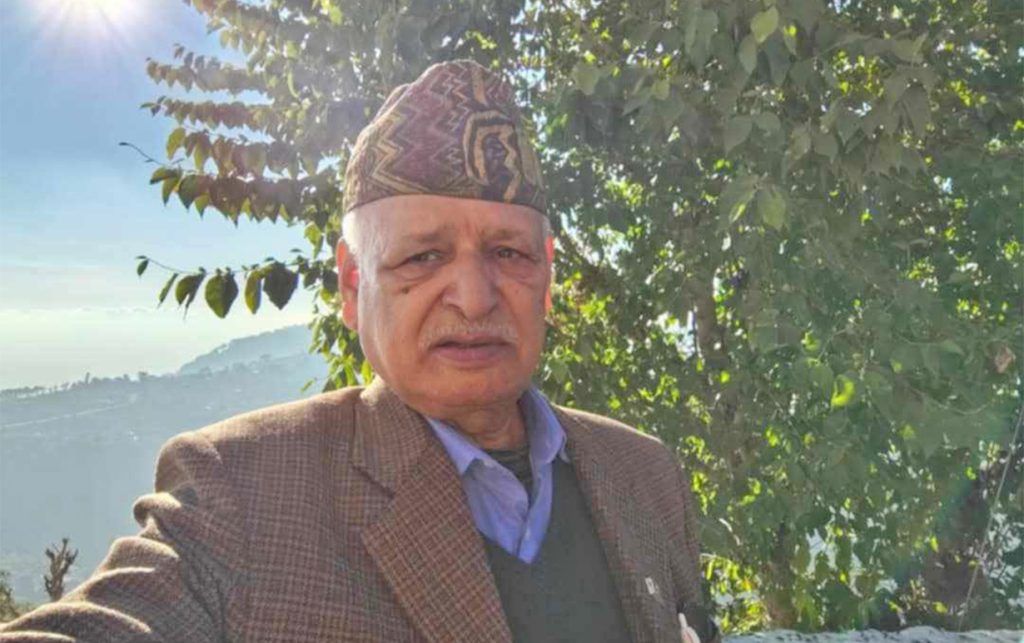

According to the central bank, old notes worth Rs 40 to 50 billion are destroyed every year. Nepal says until 2021, the NRB has destroyed notes worth Rs 560 billion. Most of these notes are those with smaller denominations, says Nepal. A former NRB governor Dipendra Bahadur Chhetri says sometimes the bank receives notes after two days of issuing them.

“The amount of times one note is circulated is quite high in Nepal. That is why these notes go bad in as little as one day,” says Chhetri.

He says these notes go bad because everyone has a different way to keep them. Some keep them nicely, some fold them, some crumble them while in some cases people even handle them with their wet hands.

“It’ll obviously go bad when these things like these happen,” says Chhetri.

He says as per the quality of notes, they tend to go bad quite quickly. Compared to dollars, pound sterling, yen and euro currencies, Nepali notes are printed in inferior-quality papers.

“Yen uses the same raw material as lokta paper, but that’s expensive and as we can’t afford it, we use a cheap one,” says Chhetri.

Destroying old notes and printing new ones is also causing a lot of financial burden on the country, says Nepal.

“It’s an endless loop of losses. Around 15 to 20 per cent of new notes are useless in four months of circulation,” says Nepal.

No respect to resources

Citizens Bank CEO Ganesh Raj Pokharel says people are realising the ill-handling of notes and have been keeping them safe.

“We need to raise awareness because not all of us keep money in our wallets. Some fold it while some crumble it and put it in their pockets. If we start keeping our money without folding it in our wallets, notes will last long,” says Pokharel.

But due to different sizes of people’s wallets, this is not possible.

Nepal Microfinance Bankers Association’s vice-chairperson Min Bahadur Bohara says people in rural areas lack awareness about the need to take care of the new notes. But that said, he says that people in urban areas, even though they are aware, do not care about the need to look after new notes.

“Conductors in busses don’t keep notes safely and meat shops hand over wet notes to people even though they know these notes go bad soon. They don’t lack awareness; they just don’t care,” he says. “In villages, they are kept in a pouch or in a box. But they are never wet. People in rural Nepal care more even though they lack awareness.”

But, when the same urban people carry the Indian rupees or US dollars, they tend to keep them safely, he says. The US dollars, if treated like Nepali rupee notes, will not be taken by anyone. Experts argue that Nepalis just do not respect Nepali notes compared to foreign ones.

The charge on culture

According to Nepal, the executive director of the NRB Currency Management Department, notes go bad due to cultural reasons too. In the Hindu culture, people offer money to gods and goddesses. Money is also handed out as dakshina, during every event. This money used that time is covered in vermilion powder among others, which damages the notes.

“I talk about note safety when I myself can’t guarantee its safety at my home,” says Nepal. “Some rituals ask us to carry the note and water at the same time. When this happens, how do we guarantee its safety?”

NRB spokesperson Dev Kumar Dhakal says Nepalis’ nature is also to blame for notes going bad quickly.

“People take it for granted. Touching money with wet hands and crumbling it and putting it in their pockets doesn’t help the life of these new notes,” says Dhakal.

Interestingly, the NRB even held discussions with astrologers and priests on how to extend the life of notes circulated in the market. But, that discussion was not fruitful at all.

Santosh Vashistha, an astrologer and priest, during the discussion did say that the use of the money during various rituals was not compulsory and not sought by the scriptures. He says it is wrong and is a new phenomenon started by a new generation of priests.

“Nowhere is it written that people need to offer money. In our culture, we offer coins, not notes, but here people have started to offer notes as its denomination is high and that is wrong,” says Vashistha.

High printing costs of the notes

According to Laxmi Prapanna Niraula, a former executive director of the Currency Management Department of the NRB, printing new notes costs Nepal around Rs 400 million a year. Nepal does not have a note printing machine and it asks foreign countries to print them, which also results in the decrease of foreign currency reserves in the country.

“If we take care of notes, we will save a lot of foreign currency from going abroad,” says Niraula.

Additional money is also wasted on the distribution of these notes to rural parts of the country.

According to the NRB, it costs more to print notes of small denominations. Officials say it costs Rs 1.68 to print a Rs 5 note while it takes Rs 1.40 to print a Rs 10 note. The bank spends Rs 1.73 to print a Rs 20 note and Rs 2.99 for a Rs 100 note. The central bank stopped printing Rs 1 and Rs 2 notes because it cost a lot to print those. To print a Rs 1,000 note, Nepal has to pay Rs 3.37 while to print a Rs 500 note costs Rs 4.68.

Legal efforts

Meanwhile, Niraula says the NRB has to become strict in order to save new notes.

In order to save notes, the NRB had drafted a Clean Note Policy in 2016. In the policy, the NRB has asked banks to set three categories of notes – ideal for ATMs, ideal for their cash counters and lastly, not ideal for both. The policy also states people are not allowed to write on notes as it wanted people themselves to preserve notes.

Even the law prevents people from doing so as section 264 of the National Penal Code Act states a person will be jailed for three months if he/she damages a note and will be fined up to Rs 5,000.

Despite jail terms being listed, people still continue to damage notes purposely as laws have not been effective enough, says the NRB spokesperson Dhakal.

Former governor Dipendra Bahadur Chhetri says people still are not aware of the consequences of damaging notes that are national property. He says as the policy cannot figure out who damages these notes, the bank cannot punish the culprits.

“Even when there are proofs, we still haven’t been able to book them. An example is finance companies putting their stamps on notes. Why haven’t we been able to stop these people from repeating the same thing?” says Chhetri.

He says people need to promote the use of digital banking as it will save the nation a lot of money.

The executive director of the NRB Currency Management Department, Nepal, says the officials are also talking about adding the need to save notes into the syllabus so that children learn this from an early age. This proposal has been taken to the Curriculum Development Centre but is yet to be implemented.

“If kids learn this from an early age, it will be easy for us to raise awareness. This is being done in many developed countries,” says Nepal.