In Nepal, the digital payment ecosystem has been rapidly evolving in recent years. The nation’s reliance on a traditional cash-based economy has progressively shifted towards digital transactions, with the proliferation of various digital payment solutions and forward-thinking initiatives. This has not only streamlined digital transactions but has also brought greater efficiency, security and convenience for both individuals and businesses.

Not too long ago, Nepal’s banks and financial institutions heavily relied on a manual paper-based cheque clearing system. It not only involved physical movements of cheques from one bank to another, making it time-consuming and cumbersome, but also had a high risk of errors and fraud as the customers had to wait for days, sometimes even weeks to receive the money.

Recognising the need for digitalisation, Nepal Clearing House (NCHL) was established in 2008 at the initiation of Nepal Rastra Bank to foster an efficient, secure and quick cheque clearing system that marked the beginning of the transformation from physical cheque clearing to a digital clearing platform. Hence, Electronic Cheque Clearing ( NCHL- ECC) was introduced in the year 2012.

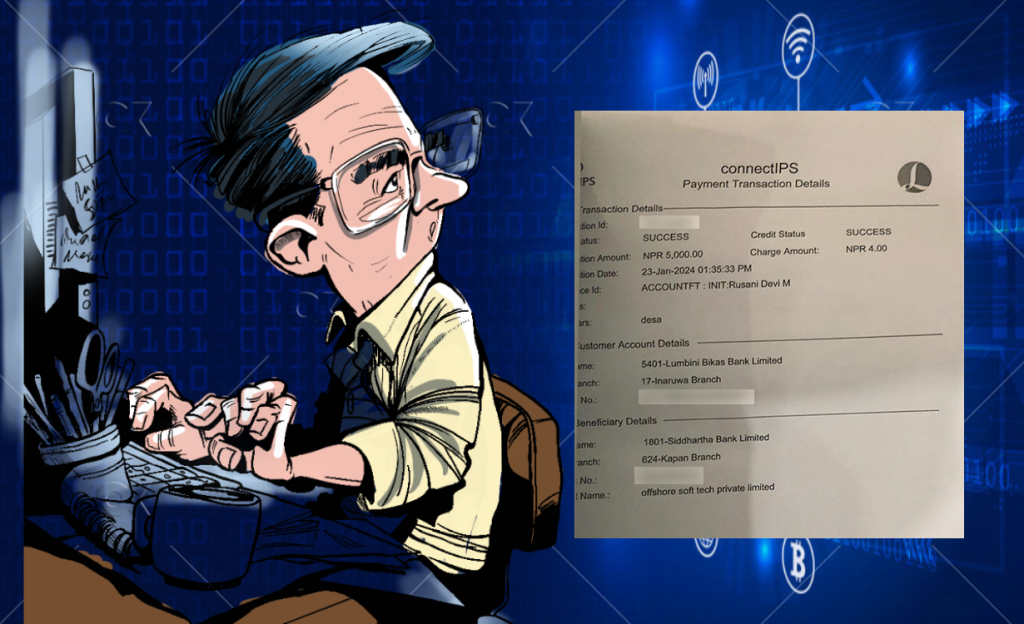

As the digital payment landscape in Nepal continues to evolve, NCHL gradually expanded its services to provide more digital services which led to the establishment of the Interbank Payment System (NCHL-IPS) in the year 2016. Furthermore, to enhance the access of individual bank customers to digital payment services, a multi-banking single platform – connect IPS was introduced in the year 2018 to initiate efficient, secure and cost-effective digital transactions.

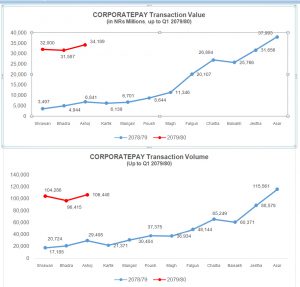

NCHL remains steadfast in aligning with the vision of Nepal Rastra Bank. In pursuit of this vision, NCHL operates multiple national level payment and settlement systems including NCHL-ECC, NCHL-IPS, connect IPS, National Payments Interface (NPI, CORPORATEPAY, connect RTGS, National Archive System, National Payment Switch (NPS) and Retail Payment Switch (RPS).

Furthermore, under RPS, NEPALPAY QR, NEPALPAY Instant, NEPALPAY Tap and NEPALPAY Request services are available. Additionally, in its commitment to delivering rigorous services and fostering greater interoperability, encompassing QR codes and a wide range of other services, NCHL has built strategic partnerships with various PSO/PSPs of the nation to facilitate non-banked customers as well.

The impact of NCHL’s services has been transformative across various sectors. Today, digital payments are used in almost all sectors, including government, semi-government, non-governmental organizations, and share transactions. With a simple tap, customer, business houses, and corporates can initiate transactions of all sizes from the comfort of their home, without having to worry about the risks associated with cash transactions. This shift is a significant step towards realizing a cashless future and embracing a digital economy.

As Nepal continues to develop its financial infrastructure, online transactions are poised to become an even more important part of the country’s financial landscape. The exponential growth in digital payments in Nepal is a positive indicator of the country’s journey towards a more cashless economy. With the advent of new technologies and the widespread use of mobile devices, digital payments have become more accessible and convenient than ever before.

Moreover, digital payments also offer greater transparency and accountability. With traditional cash transactions, it can be difficult to track and verify transactions. However, with digital payments, every transaction is recorded and can be easily traced, making it easier to prevent fraudulent activities.

NCHL has also played a pivotal role in the digitalisation of financial services in Nepal. Its payment systems have made it possible for customers, and businesses to make payments and transfer funds using their mobile phones. This has made banking services more convenient and accessible for customers and has helped to reduce the cost of transactions.

In its pursuit of advancing financial inclusion and fostering a digital economy, NCHL has bridged the gap between banked and unbanked populations, profoundly impacting lives across the nation. Furthermore, NCHL is dedicated to upholding the digital literacy framework established by the Nepal Rastra Bank (NRB).

This commitment is evident through the organisation’s efforts in organising diverse training sessions, seminars, and interactive programs with schools and colleges, all aimed at promoting awareness and ensuring the safe practice of digital transactions. This multifaceted approach underscores NCHL’s commitment to not only expanding financial access but also nurturing a secure and informed digital financial landscape for all.

In conclusion, Nepal Clearing House Limited stands as a cornerstone in the development of the payment systems in Nepal. Its payment systems have significantly enhanced the efficiency, security, and accessibility of digital payments in the country.

NCHL has also been a driving force behind promoting financial inclusion in Nepal, and it has helped to reduce the use of cash in the country. Its unwavering commitment to providing safe, secure, and efficient payment systems positions it as a leader in the payment system industry in Nepal, with a continued impact on the country’s financial evolution.