Nepal’s faltering renewables policy may find its solution in energy trade – hydro from Nepal, RE from India

Around 30% of Nepal’s population is still without access to electricity. So why is the share of renewable energy in Nepal’s electricity mix only 3%? It is a much debated question in the country’s hydro-dominant electricity sector, but there is little action.

In Nepal, renewable energy (RE) is still limited largely to solar panels on individual rooftops. The wind power projects are too few to be anything but show pieces, while hydropower development remains mired in controversy and unfulfilled promises. Over a century since electricity entered Nepal, hydropower still produces less than 1,000 megawatts a year, although four zeros are usually added to this number when projections are made.

RE is rapidly expanding its market globally and regionally. There has been sharp fall in production cost. Neighbouring India has been aggressively investing in solar power production. Bihar and Uttar Pradesh – two Indian states that have long borders with Nepal – have made significant progress in solar power production in recent years.

But Nepal has not attracted RE investors, due to the small size of the market, relative lack of land available for large-scale solar projects and an incompetent subsidy model. Experts advise the government to fix bugs quickly.

Hydro versus renewables

Amrit Lal Nakarmi at the Centre for Energy Studies at Institute of Engineering in Tribhuwan University calls Nepal’s hydro-dominance conversation a Hobson’s choice. “Politicians and policymakers are providing a Hobson’s choice (a technically “free” choice that has only one possibility) by saying Nepal has huge hydropower resources and its economic development is only possible by tapping it and exporting it to neighbouring countries. But they ignore other choices like developing some hydropower and renewable energy for domestic consumption and substitute huge import of fossil fuel from India and thereafter sell whatever is possible to the neighbours. This needs correction.”

Others also see the deep-rooted hydro-dominant electricity policy as a problem. “Nepal’s debate has always been on whether hydro or non hydro (solar, wind) sources of energy rather than hydro and non-hydro sources of energy,” says Bibek Chapagain, development specialist at the Millennium Challenge Corporation — a US government-funded initiative on infrastructure that aims to increase availability of electricity and lower transportation costs. “This has been the fundamental problem in Nepal’s electricity sector and it still prevails.”

“Fossil fuel investment has stagnated globally and much of the investment is being redirected to renewables. So, if Nepal does not differentiate mainstream hydro from other renewables it is very likely that incentives meant for non-hydro sources like solar and wind get channeled to a source like hydro that already has an established consumer mechanism. As a result, the sources within this sector that really need promotion do not get promoted,” said Amitabh Saha, Director in Energy and Resource Practice with Deloitte Touché Tohmatsu India LLP said during one of the four-series RE debate held by the Nepal Economic Forum in Kathmandu in the past couple of months, in partnership with The Asia Foundation.

Nepal’s government has said it is trying to fix the problem. A draft bill says promotion and development of hydro, solar and wind should not differ; the only difference should be in the incentive mechanisms. “Energy development is complex, and we are trying to fix our past problems of differentiation. But it’s challenging as it depends on scale of production as well as source and interest of the developer,” says Toyanath Adhikari, Joint Secretary at the Ministry of Energy, Water Resources and Irrigation.

Investments killed by subsidies

Nepal established an Alternative Energy Promotion Centre in 1996. It has focused on household-level rural energy supply through solar and micro-hydro and promotion of biogas for cooking. But it has failed to upscale RE development at industrial level. Many blame the country’s subsidy policy, saying it does not promote innovation in the sector and has failed to attract investors within the country and outside.

In last two and half decades, Nepal’s total RE production has been 50 MW – less than a single medium-level hydro project in neighbouring countries. Due to its focus on reaching out to people living in remote mountain areas, the RE policy has a heavy subsidy component. “Subsidies failed to serve as a market-starter and proved to create more inefficiencies in the market by turning out to be a bad habit for institutions and a reason behind the lack of innovation,” added Chapagain of the Millennium Challenge Corporation.

In public, the Nepal government says its RE policy is a success because it has reached 18% of its 29 million people. But its own 2016 RE policy document admitted that the country had failed to mobilise private investment to its highly subsidised mechanism. “Subsidy from the government has not effectively mobilised private investment or commercial credit into Nepal’s renewable energy sector till date to the extent envisaged,” it read.

The RE policy was introduced in 2006. The subsidy policy was started in 2012 and amended in 2016. It provides up to 65% subsidy for solar photovoltaic systems in public institutions in rural areas and 60% subsidy for photovoltaic drinking water or irrigation pumping systems.

“Subsidies are creating a long term reliance on free money and free cash handouts, which in turn infiltrate behaviours,” says Yanki Ukyab, Fellow at the Strategic Advisory Group, Infrastructure (Water, Energy & Hydropower) in Nepal. “Alongside, the price ceiling that subsidies create has also discouraged many competitive private firms from entering the renewable energy market.”

Some experts believe the RE sector does need subsidy at the beginning, and Nepal’s real problem is the absence of a subsidy exit plan. “It is not about whether we needed subsidies or not” says Narayan Prasad Chaulagain, energy expert and former executive director of Alternative Energy Promotion Centre. “It’s more about did we make our subsidies smart to bring in new innovation? Subsidies are good at a certain level, but overdependence is a problem and we failed to have a clear exit plan from the subsidy policy.”

“International investment is key for renewable energy development at large scale, but Nepal has not stood as an investment friendly country,” says Pratik Man Singh Pradhan, Vice President, Business Development & Projects, Butwal Power Company Limited. “For example, one Korean company has been struggling to get started and a few Norwegian companies have already left the country due to unfriendly investment environment.”

India’s RE growth affects its development in Nepal. In 2017, Nepal imported electricity worth 2 billion Nepali rupees (USD 17.8 million) from India. The energy imported mostly comes from coal-fired power plants. Now with the Indians states of Bihar and Uttar Pradesh producing large amounts of electricity from solar, experts say Nepal’s RE development will face more challenges. More investments in Bihar and Uttar Pradesh may make those states energy surplus soon. At the same time, Nepal may be energy surplus through hydro projects, with 2,000 MW under construction and 25,000 MW more in planning stages. That would mean less priority to renewables like solar and wind in Nepal.

Hydro from Nepal, RE from India

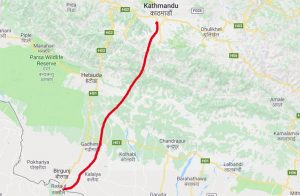

But this also opens up the possibility of a new win-win energy trade between the two countries. “While Nepal has low peak energy demand from May to September, eastern India has high peak demand at that time; whereas in January and February when India has low peak demand, Nepal has higher demand. This is perfect for energy trade. It’s not coincidental. It prevails every year due to the seasons,” says Ramapati Kumar, Chief Executive Officer at the Centre for Environment and Economic Development (CEED) Nepal.

This is something India has been wanting.

According to a report by the CEED counterpart in India, Bihar’s capital Patna alone – a city where the peak demand does not exceed 600 MW – has the potential to produce 759 MW of solar power. “It’s likely that Bihar will produce hundreds of megawatts in the next few years from solar as per its current policy that aims to add 3,343 MW of renewable energy by 2022 with about 2,969 MW from solar alone. The same is with Uttar Pradesh. Nepal needs to prepare its energy strategy immediately,” says Abhishek Pratap, Director of Programmes at CEED India. “Nepal also needs to think about how to mainstream renewable energy in its energy mix before it’s too late.”

This will increase energy trade between the two countries. But Nepal’s own RE development will still be in peril. “Nepal can focus on renewables like solar and wind to meet domestic need and export hydropower to India. So renewables won’t be in trouble. But it needs a long-term strategy of energy mix between hydropower and other renewables,” adds Pratap.

The story first appeared on The Third Pole. Read the original story.