Every day from 11 am to 3 pm, Ramila Bhattarai Khatiwada, from Khotang, is glued to her phone. She does not watch YouTube or Netflix. Instead, she refreshes the website of the Nepal Stock Exchange looking at the changing prices of shares.

Two years ago, she had no idea how to trade shares. But now, she does and has shares of 22 companies in her portfolio. “I only had IPO shares, but now I’ve ventured into the secondary market which has been quite profitable,” says Khatiwada.

She entered the market with the money she received selling goats. She started off by investing a few thousand rupees, which quickly reached Rs 400,000, getting her a profit of Rs 40,000 a month.

By May 2021, her portfolio reached Rs 600,000. She was holding on to her shares waiting to sell them after the market went up, but sadly, it did not and she was quite worried.

But, things changed in the market as the government changed. The bullish trend continued and with that, her portfolio has increased as well.

There are many people like Khatiwada who have recently developed their interest in the stock market. The rising attraction shows the market has grown in such a way that it affects thousands of Nepali families individually. It had not been a case in the past.

Similar stories everywhere

Indira Regmi also dipped her hand into the share market after her income was affected by the coronavirus pandemic. Regmi, who runs a hostel in Lalitpur, invested whatever she had in savings into the share market.

“Initially, I did mess up but gradually I started understanding things. Now, I earn enough to sustain myself,” says Regmi.

She says that she has learnt a lot in the past few months as she has profited and lost money. She had made a handsome profit on a few shares and wanted to sell before the market went down. But, the fear of missing out meant she did not.

“Since then, I set a profit margin and trade shares. I’ve stopped being greedy,” says Regmi.

—

Padam Regmi from Gulmi also entered Nepal’s share market after he was allotted shares of the Nepal Infrastructure Bank. He had been told that he would never incur a loss if he invested in IPOs alone and jumped into the bandwagon.

Since then, he has applied for all IPOs and has made a good enough profit from them. But, he has yet to venture into the secondary market because he knows how risky it is. That said, he has gone through all possible procedures to enter the secondary market.

“I’ve opened a TMS (trade management system) and am looking at how to move forward now,” says Regmi who does not think he is going to be a full-time trader as he already has a farming business.

—

Bikas Shrestha from Udayapur lost a lot of money in the share market. But, he has taken that as a life lesson. A transport businessperson, Shrestha’s income stopped once Nepal was hit by Covid-19. After his peers asked him to invest in Nepal’s share market, he thought about it and invested in it having seen his friends make a good profit.

In the secondary market, the first share he bought was Standard Chartered Bank’s 200 units. After that, he bought 500 units of the Global IME Bank and 1,000 units of Singati Hydro. He continued to purchase shares he felt would get him a profit.

But, as he entered the market, the market did not go up. Even when it went up, he did not sell as he felt holding shares during this bullish trend would be the right thing to do. He started joining various share-related groups and started listening to a lot of people regarding how the price of shares would go up.

“People in various groups started to say how prices of Muktinath and Garima development banks would go up. Hearing that, I margin-lent and bought the shares of these banks. But, that was just a hoax a and the prices didn’t go up and I incurred quite a loss,” says Shrestha.

Despite incurring a loss, he says he has learnt a lot from this as he says he will now assess things before investing.

—

Bigya Pokharel from Thimi of Bhaktapur also says that the share market has taught her to respect money and to have patience. She entered the share market a year ago after applying for an IPO, and by Dashain, she entered the secondary market.

“I don’t know how much I’ve made, but this has been quite profitable,” says Pokharel.

—

Parsa’s Sadhu Sah who had mostly been busy with agriculture also got into Nepal’s share market in the past year. He says the share market has given him a new means to earn money to sustain himself.

“We can’t be reliant on agriculture throughout the year. This has given me a good chance to make some money when it’s offseason,” says Sah who entered the market after hearing the village’s teachers talk about NEPSE and the money that can be made through it.

Changing times

Damaru Ballav Ghimire has been investing in the share market for the past 45 years. He says that in this time, a lot has changed in the market. When he started, one could apply for as many shares as one could. The number has been limited to 10 units for most IPOs now.

“There were only a few people who applied for IPOs. If you wanted 100 units, you could apply, but it was hard to manage capital to apply more shares,” says Ghimire.

He says the number of people investing in shares has also changed. From investment firms to farmers, currently, over 1 million people have invested in the Nepal share market.

“Everyone from the east to the west is involved in Nepal’s share market,” says former president of Stock Broker Association, Bharat Ranabhat.

More people have joined in due to the use of online transactions to trade. All one needs to trade shares is a mobile phone and the internet. While everyone had to go to a broker’s office in the past, now they can do things in the palm of their hands. Ranabhat also says that people have been learning about the share market from the internet that has also helped the market. That said, Ranabhat says that people must fill the forms carefully, otherwise, problems can arise while trying to trade shares.

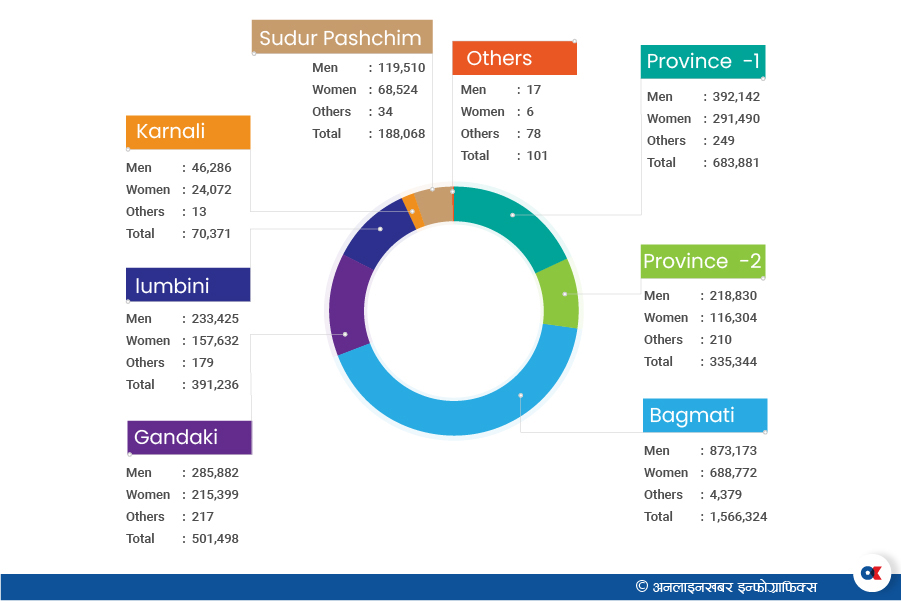

According to CDS and Clearing Ltd, the NEPSE-promoted company formed to provide centralised depository, clearing and settlement services in Nepal, the most number of investors are from the Bagmati province. The company says there are 1.6 million people from the province invested in the market while Province 1 is second with around 700,000 and Gandaki third with 500,000. Province 2 has around 335,000, Lumbini has 400,000 and Sudurpaschim has 188,000 people invested in shares.

Karnali is the lowest as only 70,000 from the province are invested in Nepal’s capital market.

Housewives find financial independence

Nepal’s capital market has also given housewives the chance to make money. As of today, there are 1.5 million women investing in the share market compared to 2.1 million men. There are two share investor associations in the country and both of them are led by women: Radha Pokharel is the chairperson of Nepal Punjibazar Laganikarta Sangh while Samarkshyana Chaudhary is the chairperson of Nepal Punnjibazar Sangh.

Pokharel says she is seeing a lot of women, particularly housewives, invest in the share market.

“We’ve been going out of the valley to see how we can’t develop the market and we’ve seen that a lot of women have been investing. We’ve been getting calls asking us to help explain to them how the market works and how they can invest in it,” she says.

Pushpa BK, like many others, entered the share market when NIFRA announced its IPO. She was allotted 50 shares, for which she had spent Rs 5,000. In a few months, that Rs 5,000 became Rs 30,000 which made her apply for every IPO that was announced after NIFRA.

“I apply for all IPOs. Some I get and some I don’t,” says BK, who is planning to enter the secondary market.

She says that the market has given her financial security as she no longer has to ask her husband for money to do things that she wants.

Interest in the monetary policy

Three years ago, only 40 per cent of Nepal’s population had access to banks. The number has now increased to 65 per cent, according to Nepal’s central bank.

As it is mandatory to have a bank account and a demat account before entering the share market, the number of people who have opened bank accounts has also significantly gone up, admit the Nepal Rastra Bank officials.

To raise banking awareness among people, the central bank also started ‘one person, one bank account’ campaign. But, the share market did more than that campaign in raising the number of account holders in the country.

The former president of the Stock Broker Association, Ranabhat, says the share market has also helped people understand the importance of money. He further adds that the share market has also helped the banking sector in current times.

“People even in the remote parts of Nepal have understood the importance of the share market. In the past, people bought land, but now they buy shares,” he says.

This, Purna Prasad Acharya, the CEO of the CDS and Clearing Limited, says has made people look forward to the monetary policy. “The market has raised a lot of awareness as people are keen on the policies that the government and the central bank will bring,” says Acharya.